Details on tax credits offered to companies remain confidential, but the Tennessee Department of Economic and Community Development is now announcing the amount of FastTrack grants it’s offering businesses within 30 days of a project’s announcement. The state previously waited to announce the grants until it signed contracts with businesses detailing the grants’ terms.

So if you’re curious about how much money companies will get from the state in order to locate or expand in Tennessee, you can go to a searchable database on TNECD’s website.

“This searchable database is designed to better assist the public in accessing project data for FastTrack grants with pending contracts,” TNECD states.

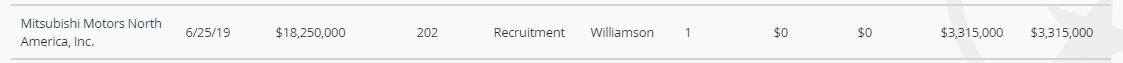

Recent entries include the $3.3 million grant offered to Mitsubishi Motors North American to move its headquarters from California to the Nashville area. The company says it bring 200 jobs to the area and invest $18.25 million on a new facility in Williamson County. That deal was announced June 25th.

Other recent large grants on the database include $1.3 million to Western Express, a trucking company that plans to spend $88 million to expand its Nashville headquarters, and $800,000 to Ebm-pabst, a German electric motor and fan manufacturer that plans to build a $37 million plant in Washington County, Tenn. The database also includes grants of as little as $14,000 - the amount Memphis Record Pressing will receive due to the vinyl records pressing plant’s planned expansion in Memphis.

You can’t find similar data on tax credits, another form of incentive that Tennessee offers to expanding or relocating businesses. Tax information about specific companies is confidential under state law. This year, lawmakers proposed exempting economic development tax credits from the confidentiality requirement. Under the bill, the public could see what companies get this tax break, where they are located, how many jobs they create, and how much money they spend on machinery and other capital investments.

However, state economic development officials objected to making this information public, saying it would hurt their efforts to recruit new businesses. Although tax credit information is made public in 28 states, some of Tennessee’s main competitors for economic development deals, such as Georgia and South Carolina, don’t disclose this information.

Image via Tennessee General Assembly